child tax credit september 2021

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. This first batch of advance monthly payments worth.

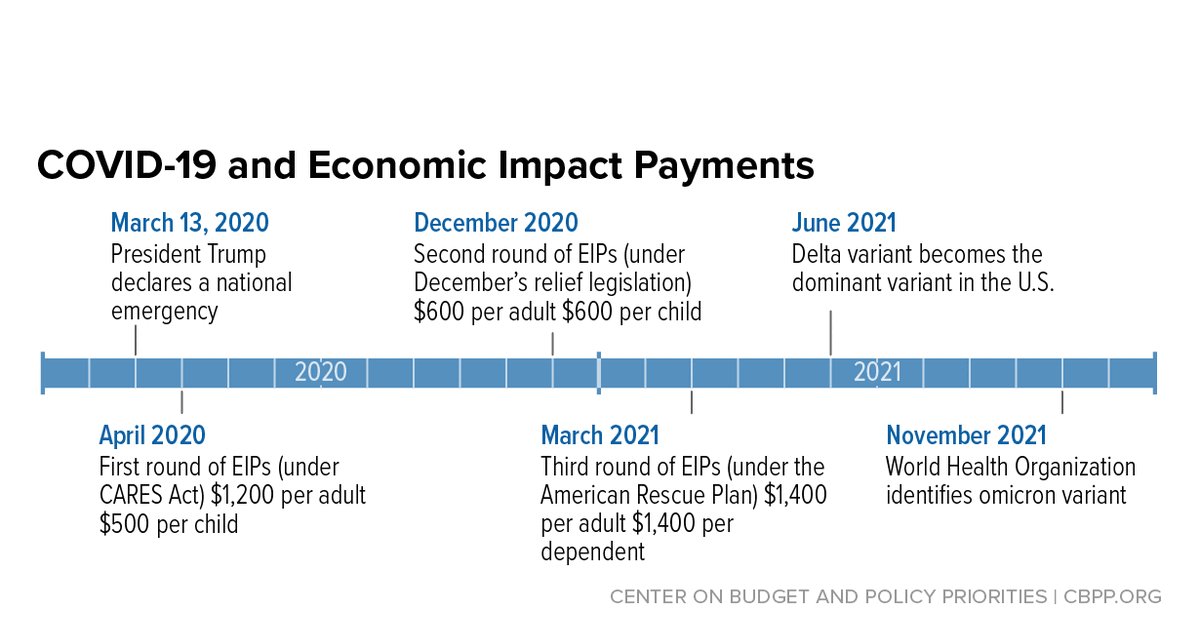

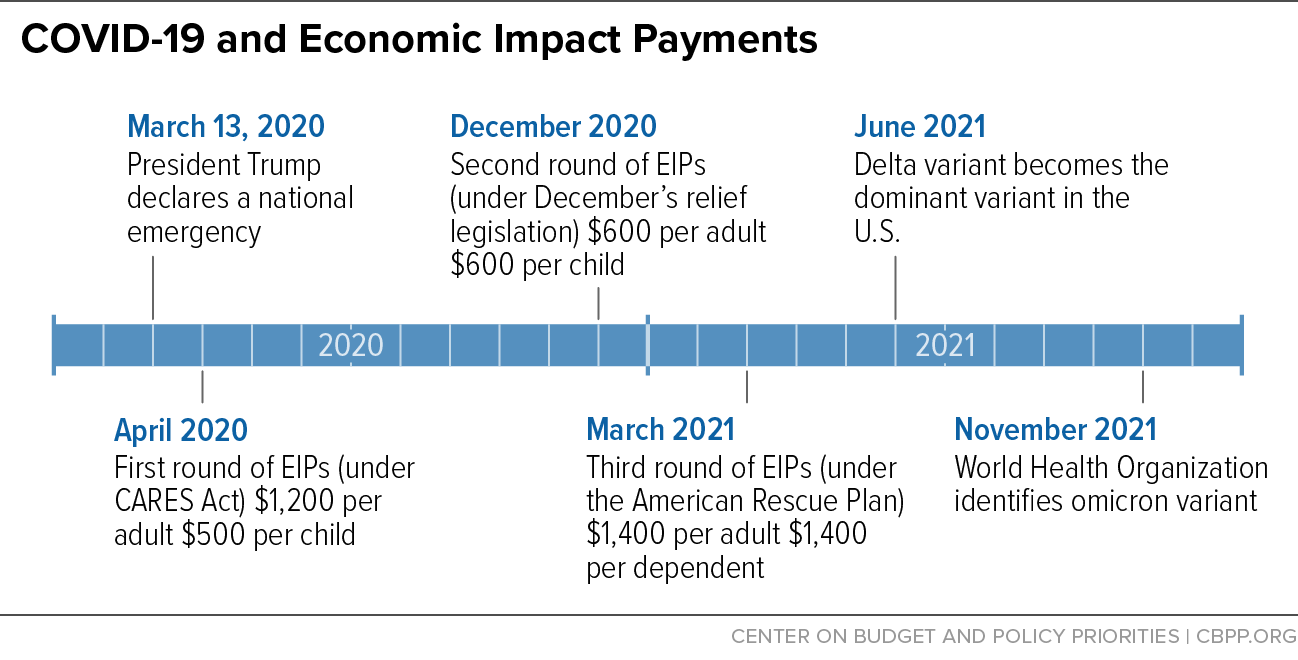

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of cash to millions of families.

. We need this money. Millions of families across the US will be receiving their. The September installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail.

Enter your information on Schedule 8812 Form. E-File Directly to the IRS. Likewise if a 17-year-old turns 18.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The IRS will soon allow claimants to adjust their income and custodial. Distribution of the federal tax benefit of the Child Tax Credit CTC assuming extension of the CTC credit increase amount and increase in eligible age.

Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. And extension of the ARP Acts CTC expansion including full refundability. By making the Child Tax Credit fully refundable low- income households will be.

The monthly child poverty rate increased between August and September from 115 percent to 132 percent due to the expiration of expanded unemployment benefits across the country and the rollback of Supplemental Nutrition. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. Aggregate tax expenditure amount billions for the child tax credit CTC for calendar years 2022-25 under three scenarios.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The third monthly payment of the expanded Child Tax Credit CTC kept 34 million children from poverty in September 2021. We provide guidance at critical junctures in your personal and professional life.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. The September installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail. The credit was made fully refundable.

Ad Tax Strategies that move you closer to your financial goals and objectives. This third batch of advance monthly payments totaling about 15 billion is reaching about 35. T21-0226 Tax Benefit of the Child Tax Credit CTC Extend ARP Provisions but Retain Current-Law Partial Refundability by Expanded Cash Income Level 2022.

The child tax credit was expanded for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. See what makes us different.

The credit amount was increased for 2021. September 10 2021 at 700 am. Starting in July.

Home of the Free Federal Tax Return. Eligible families who make this choice will still receive the rest of their Child Tax Credit as a lump sum when they file their 2021 federal income tax return next year. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Get your advance payments total and number of qualifying children in your online account. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. How much will parents receive in September.

614 PM EDT September 14 2021. 614 PM EDT September 14 2021. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

September 16 2021 735 AM MoneyWatch. IR-2021-153 July 15 2021. IR-2021-188 September 15 2021.

Extension of the American Rescue Plan ARP Acts CTC expansion but retaining partial refundability. Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia Adamczyk AliciaAdamczyk. To stop all payments starting in September and the rest of 2021 they must unenroll by 1159 pm.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. To reconcile advance payments on your 2021 return.

We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. We dont make judgments or prescribe specific policies. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

For married couples each spouse must unenroll separately. ET on August 30 2021. 中文 简体 September 17 2021.

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

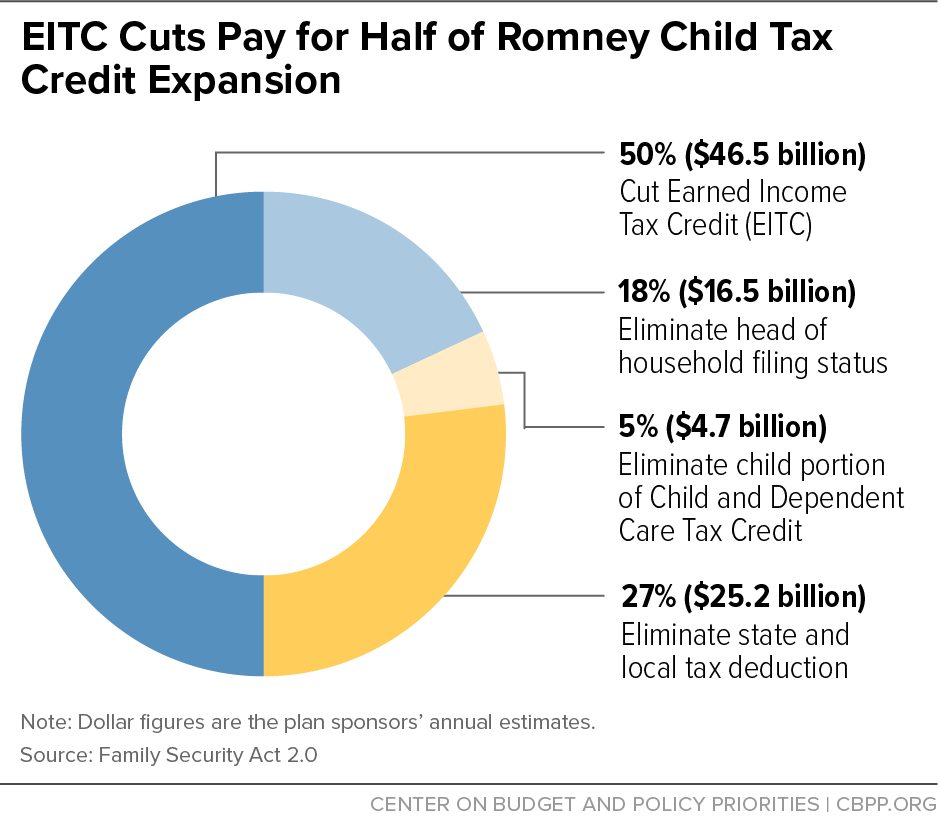

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits

Mcq 211 Concept Assessment Test Civil Construction

Banking Financial Awareness 1 2nd September 2020

Infosys Deadline To Fix Tax Filing Portal Is September 15 India S Tax Deadline Is 15 Days After Tax Deadline Filing Taxes Wealth Planning

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Latest News Chartered Accountant Equity Accounting

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Daily Banking Awareness 30 And 31 May 2021 Banking Awareness Financial

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review